How emotions and the markets are alike

It is come to my attention that my clients call me the most when the stock markets experience high levels of volatility and losses. This of course is due to an event in the market, or in todays case many events, that based on history has always been short-lived. But these times tend to be the only ones investors recall during the life of their investment time horizon. I don't get many calls when the markets are slowly progressing upward. It's almost as if it is expected that the market should always move up.

But markets are irrational. They have no rhyme or reason for the direction that they go. One day a company will have a surprise in earnings and your balance will shoot up. Other days a random Fed member will sneeze and the markets drop. But once again I don't get calls on the up days because it is just expected to be that way. The truth is that history has always shown us that progressive upward movement in the market always has crashes somewhere in between.

To be exact there has been 14 bear markets since 1947.

The astonishing thing outside of the fact that there has been so many bear markets, is that no one seems to have learned their lessons from these crashes. I'm not complaining because if the markets always went up then I wouldn't have a job. I'm also not saying that I will beat the market when there is a crash but I am very good at reminding my clients about the lessons that are always forgotten. My job is to shoulder the emotions that come with market swings and remind my clients that this isn't the first time this is happened.

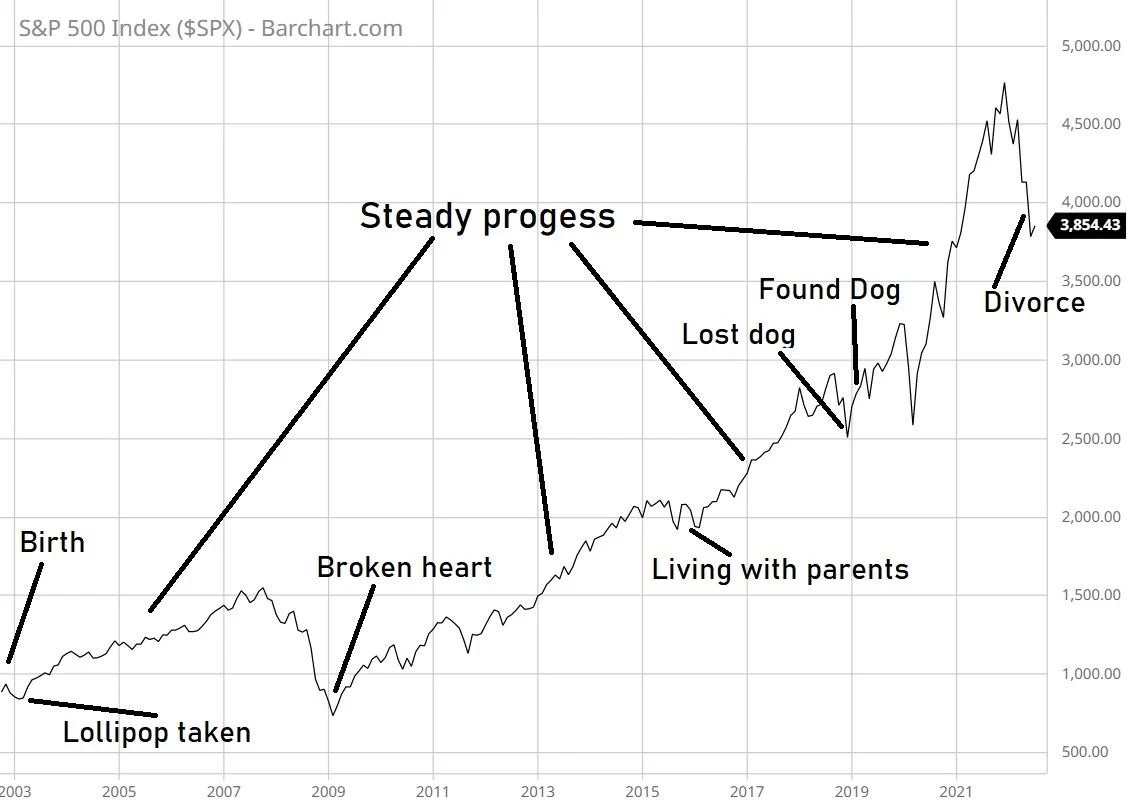

Recently I was staring at a graph of the S&P 500 over the past 20 years and studying the events that caused it to behave the way it has and realized there is a correlation between the line graph of market to and my emotional life. Not just my life but also the lives of my clients. I thought that if I created a line graph of my emotions throughout my life and how they were impacted by major life events it wouldn't look so different from the S&P 500 history. Long periods of slow and subtle progress with large dips every few years.

Try this experiment yourself. At birth you start in the very lower left-hand side of the graph and as you grow you learn to walk, to run, to think, to love, and even how to learn. The graph would be a slow steady progression upwards towards the upper right corner of the graph. Somewhere in that slow steady progression, around 2 1/2 years old, your parents took away a lollipop and it was the most devastating moment of your life. This will be reflected on the graph as a massive dive in value. But you would recover in very short time. Over just a few months it is completely forgotten and the subtle progress continues. Slight emotional volatility is present every day but the line is still trending upward. Suddenly you're seven years old and your girlfriend or boyfriend in school slips you a note saying “I'd rather share my lunch with somebody else.” Being dumped hurts. Physically and emotionally you don't think it's possible to go on. Another dive in your graph. Once again and in short time you forget and you start progressing again in small unrecognizable ways. You run into events like this for the rest of your life. They do get worse but no matter what you still progress. I don't know anyone who can tell me they aren't better off now than they were when they were a little baby. Even with those massive emotional crashes you are still standing here today and progressing still.

Now compare your graph to the balances of your investments. If you started investing 20 years ago and you stuck to a plan you are almost certainly in a much better position now than you were then. Even with all of the bear markets and recessions. The problem with this is that no one recognizes the slow, steady, and subtle progression they experience while investing. The only thing investors remember is when they felt that they lost it all. And I can't blame them. These are very traumatic events and they didn't feel good. It hurt a lot and if you didn't have somebody to help you through the process it would hurt a lot more. Because you would only have yourself to blame.

The best advice I can give is the same advice that you likely gave yourself and during all of those tough times. This too shall pass. Even if your balances drop 10, 20, even 50% you must keep in mind that this is short-term and that even in this case, time heals all. Having a strategy and sticking to it and having somebody there to help you along the way will get you through the short-term traumatic times.

If you need somebody to help you through tough times in life. Not just financially. Schedule a call with me so we can create a strategy that will help you focus on your life graph rather than your investment graph.

Fiduciary Mission

At Integritas Financial, we are committed to providing fee-only, fiduciary financial planning services that are tailored to the unique needs of young professionals, particularly millennials. Our experienced planners work with you to develop customized financial plans that address key areas such as estate planning, trusts and wills, retirement, workplace benefits, education funding, student debt, and buying a house.

We believe in transparent, client-focused service that puts your financial goals at the center of everything we do. As a fiduciary firm, we are dedicated to acting in your best interests, and we never sell products that charge commissions to clients.

Our goal is to help you achieve a stable and prosperous financial future by providing comprehensive financial planning services that are tailored to your individual needs. Whether you're just starting out in your career or you're already well-established, we can help you navigate the complexities of financial planning and create a roadmap for success.