Quick Tips | Week of November 28th | Investing and Roth IRAs

Welcome to this weeks quick tips of the week. Use these ideas to improve your financial situation. Reach out to me to dig deeper into these topics.

ESG Investing

ESG investing is all the rage these days. This stands for environmental, social and governance. These investments are a way for investors to buy companies that act responsibly for the environment, social change, and doing the right thing for investors with their internal controls. An example of an ESG investment would be a company who is taking steps to lessen their carbon footprint to zero or companies taking action to help climate change.

Real Estate Investing

Real estate is a common alternative investment that is more accessible than you may think. There are vehicles called Real Estate Investment Trusts or REITs that you can buy easily in your investment portfolio. This is a great way to diversify your portfolio if you want to spread out the risk.

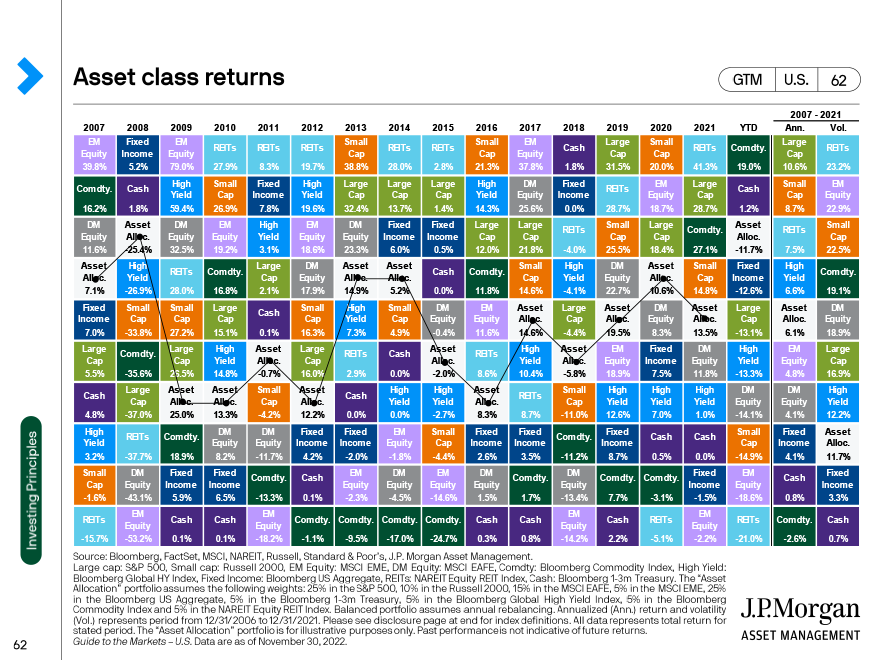

Asset Class Returns

Proper investing involves constant due diligence. The different asset classes behave differently over time. A single asset class never typically outperforms the others each year. Check out this asset class return map to see how they behave year-to-year.

Roth IRAs

Contributing to a Roth IRA, if you are below the income limits, is a way to save for retirement. Roth accounts have post tax contributions but the growth on your investments can be withdrawn tax-free if certain rules are met. Don’t delay on contributing to a Roth IRA especially if you are young.

Quote of the week

I like to follow stoics because they teach valuable lessons that translate very well to investing and our emotions. Read this quote by Marcus Aurelius.

“You have power over your mind – not outside events. Realize this, and you will find strength.”

We can apply this to financial planning by seeing how we can only influence things within our control. Market volatility and other types of risk will happen but it is how we plan for them that matters.

Fiduciary Mission

At Integritas Financial, we are committed to providing fee-only, fiduciary financial planning services that are tailored to the unique needs of young professionals, particularly millennials. Our experienced planners work with you to develop customized financial plans that address key areas such as estate planning, trusts and wills, retirement, workplace benefits, education funding, student debt, and buying a house.

We believe in transparent, client-focused service that puts your financial goals at the center of everything we do. As a fiduciary firm, we are dedicated to acting in your best interests, and we never sell products that charge commissions to clients.

Our goal is to help you achieve a stable and prosperous financial future by providing comprehensive financial planning services that are tailored to your individual needs. Whether you're just starting out in your career or you're already well-established, we can help you navigate the complexities of financial planning and create a roadmap for success.